Back

Insights

EU Economy: Weekly Commentary – Janurary 12, 2026

European Market Review

Adrian Van Den Bok and David Pintado

CEO

European Market Review

Last week, Italian bond yields declined, and the spread to German bonds narrowed. EU equities rose, led by Germany. The euro weakened, and Brent oil advanced amid supply and geopolitical risks.

Last week, bond yields declined, led by Italy. The spread between the Italian 10-year government bond and its German counterpart narrowed to 64 basis points, down from 245 at the end of 2022. This reflects reduced perceived risk and greater stability under Prime Minister Meloni, highlighting that fiscal credibility in Europe is consistently rewarded. Equity markets rose across the EU, with Germany leading gains at nearly 3% despite ongoing economic weakness. Moreover, despite these challenges, the DAX finished 2025 up 23%, marking its strongest annual performance since 2019. The euro depreciated 0.72% against the US dollar. Brent crude advanced 3.65% amid supply concerns driven by escalating protests in Iran’s oil-producing regions and renewed risks from the Russia–Ukraine conflict. Gains may be constrained by rising global inventories and persistent oversupply. Markets also monitored discussions in Washington regarding potential Venezuelan oil export agreements, which could influence long-term supply as U.S. companies plan significant investments to expand production.

Week: 5 – 9 January | |||||

Stock Market | Last | % CHG | Currency | Last | % CHG |

Euro Stoxx | 5997.47 | 2.51 | EUR/USD | 1.1637 | -0.72 |

Stoxx Europe 600 | 609.67 | 2.27 | Commodities | Last ($) | % CHG |

France | 8362.09 | 2.04 | Brent | 63.02 | 3.65 |

Germany | 25261.64 | 2.94 | Bond Market - 10 Years | Last | BP |

Italy | 45719.26 | 0.76 | Germany | 2.867% | -3.55 |

Portugal | 8520.34 | 1.43 | France | 3.530% | -8.49 |

Spain | 17649.00 | 0.90 | Italy | 3.505% | -11.35 |

Belgium | 5240.44 | 2.50 | Spain | 3.248% | -9.15 |

Europe View Synopsis

Eurozone inflation returned to 2%, supported by low energy prices, while growth moderated with services leading expansion and exports declining. Germany’s labour market weakened, suggesting cautious momentum and stable interest rates.

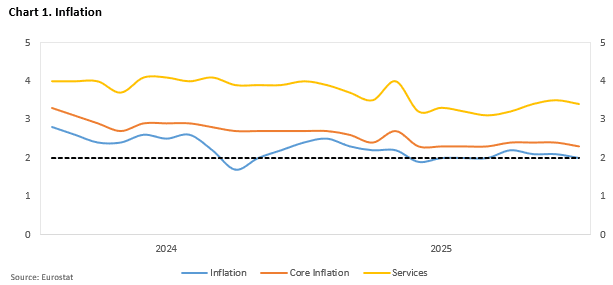

Eurozone inflation has returned to the ECB’s 2% target, with headline inflation easing to 2.0% and core inflation moderating to 2.3% in December, reflecting stable price dynamics supported by lower energy costs and slowing food inflation, particularly in Germany. Services inflation remains elevated at around 3.4%, while core inflation shows some stickiness, suggesting headline inflation may dip faster than core inflation. Looking ahead, a strong euro, low energy prices, and moderating wage growth point to further disinflation, though fiscal-driven pressures may gradually boost inflation in 2026. Eurozone private sector growth slowed in December, with the composite output index falling to 51.5, services leading expansion, export orders declining sharply, and sentiment softening, indicating cautious momentum into 2026. In Germany, the labour market weakened, with unemployment rising to 2.908 million amid structural and sectoral pressures, dampening consumption despite rising real wages. Overall, the region faces moderate growth, stable inflation near target, and labour market challenges, suggesting interest rates will remain unchanged and economic activity will be cautiously resilient.

Inflation

Eurozone inflation has returned to the ECB’s 2% target, allowing policymakers to keep rates unchanged while monitoring disinflation risks near term and potential fiscal-driven pressures later.

Eurozone inflation returned to the ECB’s 2% target in December, with headline inflation easing from 2.1% to 2.0% and core inflation moderating from 2.4% to 2.3%, reinforcing the ECB’s assessment that inflation remains in a favourable and stable range. This moderation was mirrored in Germany, where consumer prices rose 1.8% year on year in December, below the 2.1% forecast, driven primarily by declining energy prices and a sharp slowdown in food inflation to 0.8%; German core inflation also eased to 2.4%, although services inflation remained elevated at approximately 3.5%. Across the euro area, services inflation remains high at 3.4%, while energy prices continue to exert downward pressure at minus 1.9%, and core inflation has proven relatively sticky despite some easing. Looking ahead, factors including a strong euro, low energy prices, and moderating wage growth suggest further disinflation, although rising selling price expectations for goods and services indicate that headline inflation may decline more than core inflation. While a temporary dip below target cannot be ruled out, a significant undershoot is not anticipated in the base case, and inflationary pressures are expected to gradually re-emerge in 2026 as fiscal spending provides a modest boost to economic growth. In line with this outlook, the ECB projects inflation to remain slightly below target in 2026 and 2027 before returning to 2% in 2028, enabling policymakers to maintain interest rates unchanged and preserve a cautious, data-dependent approach.

We do not expect significant changes in Eurozone inflation, which should remain broadly stable around the target, and we do not foresee interest rate cuts.

Business Activity

Eurozone private sector growth slowed in December, with composite output at 51.5. Services led expansion, costs rose, exports fell, and sentiment softened, closing 2025 on a cautious note.

The Eurozone economy wrapped up 2025 with steady but moderating growth, as private sector activity expanded for the twelfth consecutive month. The composite output index fell to 51.5 from 52.8, while the services activity index eased to 52.4, marking three-month lows. Slower demand for goods and services weighed on momentum, even as companies cleared backlogs more rapidly and employment edged higher, particularly in the services sector, while manufacturing hiring remained constrained. Input costs accelerated to a nine-month high, though output prices were largely unchanged. Growth was uneven across the region: Spain saw a pickup in activity, France stagnated, and Italy and Germany posted only modest gains. New business rose for the fifth consecutive month, but export orders declined sharply, hitting their weakest level since March. Overall, the Eurozone ended the year with resilient, services-driven growth, tempered by softening sentiment and a modest decline in consumer confidence, pointing to a cautious start to 2026.

We expect moderate Eurozone growth to persist into early 2026, supported by resilient domestic demand and services activity, while weak external demand and export‑driven sectors may constrain the pace; inflation near target also suggests interest rates will remain steady and sentiment stay cautious.

German Labour Market

Germany’s labour market worsened in December, with unemployment at 2.908 million. Structural challenges, stagnant growth, and industry pressures may further suppress consumption before stabilizing mid-2026.

Germany’s labour market continues to weaken, with unemployment rising by 22,900 in December to 2.908 million, marking the highest December level since 2010, while the seasonally adjusted rate held steady at 6.3%. Over the past four years, the labour force has expanded by approximately 500,000, reflecting the combined effects of prolonged economic stagnation and structural challenges in key industries. Forward-looking indicators, including the Ifo and federal labour agency employment expectations, suggest the labour market may deteriorate further in early 2026, particularly amid ongoing cost-cutting measures, rising bankruptcies, and sector-specific pressures such as in the automotive industry, though stabilisation is anticipated by mid-year if a cyclical economic recovery materialises. These labour market pressures, coupled with political uncertainty surrounding Germany’s pension system, have contributed to subdued private consumption, which, despite a brief early-year surge, slowed sharply in the latter half of 2025 even as real wages grew nearly 3% and savings rates returned to pre-pandemic levels, with excess funds increasingly directed toward housing costs. Overall, the gradual deterioration of the labour market is expected to persist, complicating efforts to stimulate consumption and broader economic recovery throughout 2026.

We do not anticipate a recovery in the labour market during the first half of the year. However, targeted infrastructure and defence investments could support job growth as broader economic stimulus measures are implemented.