Back

Insights

EU Economy: Weekly Commentary – Janurary 26, 2026

European Market Review

Adrian Van Den Bok and David Pintado

CEO

European Market Review

European bond yields rose, except in France. Governments favour shorter-term debt to reduce costs. EU stocks fell, led by Italy and Germany. Brent crude climbed amid Iran tensions.

Last week, bond yields increased across most European markets, with the notable exception of France, where yields declined by 2.14 basis points. European governments are scaling back the issuance of long-term sovereign bonds, favouring shorter-term maturities to mitigate the impact of rising borrowing costs. As a result, the average maturity of debt issued in major Eurozone markets, including Germany, France, and Italy, is expected to fall below 10 years this year, a level not seen since 2015. The strategy aims to reduce debt-servicing costs, based on the assumption that refinancing risks remain low and that future yields will moderate. European equity markets experienced declines, led by Italy, where the main index dropped 2.11%, followed by Germany with a 1.57% decrease. In commodities, Brent crude oil rose 1.93% amid heightened tensions with Iran, as sanctions on oil shipments and an increased U.S. naval presence raised supply concerns. Further supply tightening came from the continued shutdown of Kazakhstan’s Tengiz oilfield following a fire.

Week: 19 – 23 January | |||||

Stock Market | Last | % CHG | Currency | Last | % CHG |

Euro Stoxx | 5948.20 | -1.35 | EUR/USD | 1.1831 | 2.00 |

Stoxx Europe 600 | 608.34 | -0.98 | Commodities | Last ($) | % CHG |

France | 8143.05 | -1.40 | Brent | 65.44 | 1.93 |

Germany | 24900.71 | -1.57 | Bond Market - 10 Years | Last | BP |

Italy | 44831.60 | -2.11 | Germany | 2.908% | 6.97 |

Portugal | 8557.86 | -0.94 | France | 3.499% | -2.14 |

Spain | 17544.40 | -0.94 | Italy | 3.510% | 4.77 |

Belgium | 5316.43 | -0.76 | Spain | 3.267% | 3.40 |

Europe View Synopsis

Eurozone inflation eased to 1.9% in December, driven by falling energy prices. Business activity remained modest but resilient, while German sentiment surged, supporting steady ECB policy expectations.

Eurozone inflation fell below the ECB’s 2% target in December, easing to 1.9% as a sharp drop in energy prices offset persistently high services inflation, reinforcing expectations that interest rates will remain unchanged well into 2026. Core inflation edged lower, price pressures eased across most member states, and domestic demand continued to support slightly improved growth forecasts. Business activity remained modest but resilient at the start of the year, with the composite PMI steady at 51.5 in January, as stabilising manufacturing partially offset softer services growth. Germany improved, offering tentative signs that anticipated fiscal support may be lifting business confidence, while overall growth prospects remained moderate and consistent with a steady ECB policy stance. Consumer sentiment also improved, led by Germany, where confidence reached a near four-year high on stronger exports, improving industrial momentum and expectations of increased public spending. Despite the brighter outlook, lingering structural weaknesses and renewed US-EU trade tensions continue to pose risks to a durable and broad-based recovery across the euro area.

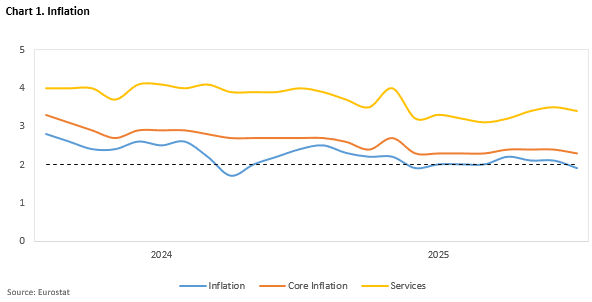

Inflation

Eurozone inflation fell to 1.9% in December, below the ECB’s 2% target. A sharp drop in energy prices offset persistent services inflation, reinforcing expectations that interest rates will remain unchanged.

Eurozone inflation fell below the European Central Bank’s 2% target in December, easing to 1.9% from 2.1% in November and undershooting expectations, according to revised figures from Eurostat, marking the first sub-target reading since May and reinforcing market assumptions that interest rates will remain unchanged. The statistical office cut its initial estimate by 0.1 percentage points, citing a sharper-than-anticipated decline in energy prices, which fell 1.9% year on year, while services inflation remained elevated at 3.4% and continued to be the largest contributor to headline inflation. Food, alcohol and tobacco prices rose 2.5%, slightly more than in November, while non-energy industrial goods inflation eased to 0.4%. Core inflation edged down to 2.3% from 2.4%. Inflation fell in 18 member states month on month, with the lowest annual rates recorded in Cyprus, France and Italy, and the highest in Slovakia and Estonia. Among the bloc’s largest economies, inflation slowed markedly in Germany and marginally in Spain and France, while Italy saw a modest uptick. The data come after the ECB held its key rates steady in December, with the deposit facility rate at 2%, and as Eurozone growth forecasts were revised higher, driven largely by domestic demand.

We expect Eurozone inflation to remain close to target in coming months, as easing energy pressures offset sticky services prices, allowing the ECB to keep interest rates on hold well into 2026.

Business Activity

Eurozone PMI signalled steady but modest growth in January. Manufacturing stabilised while services softened slightly. Germany outperformed, hinting at early fiscal support effects. ECB policy outlook unchanged.

Eurozone business activity remained resilient at the start of the year, with the composite PMI unchanged at 51.5 in January, signalling continued but modest economic expansion as softer services growth was offset by an improvement in manufacturing. The services PMI eased to a four-month low of 51.9 from 52.4 in December, while the manufacturing PMI rose to 49.4 from 48.8, indicating a slower pace of contraction and tentative stabilisation in the sector. The avoidance of a near-term trade escalation following the removal of proposed Greenland tariffs has reduced external risks at a time when surveys continue to point to only moderate GDP growth ahead despite firmer investment intentions. Manufacturing sentiment, which had been notably subdued after falling well below the 50 threshold late last year, benefited from resilient new orders and a recovery in output, pointing to emerging domestically driven momentum even as export demand remains weak amid global uncertainty. Germany stood out with comparatively strong PMI readings across both services and manufacturing, reinforcing the broader euro area picture and potentially offering the first tentative signals that anticipated fiscal spending is beginning to support domestic demand and business confidence. While hiring expectations softened in January, suggesting anticipated productivity gains rather than aggressive expansion, the PMI data also hint at gradually rising price pressures, though not to a degree likely to alter the ECB’s expectation of keeping interest rates on hold for the foreseeable future.

We expect Eurozone growth to remain modest but resilient, supported by stabilising manufacturing and firm domestic demand, while easing labour momentum and contained inflation should allow the ECB to maintain a steady policy stance.

Consumer Sentiment

German sentiment hit a four year high as exports and public spending hopes lifted confidence. Euro area morale also improved, though trade tensions and structural challenges continue to threaten a durable recovery.

German economic sentiment climbed sharply in January to its highest level in nearly four years, underscoring a surge in investor optimism despite renewed threats of US tariffs on European exports and reinforcing expectations that 2026 could mark a turning point for Europe’s largest economy. The ZEW Economic Sentiment Index rose to 59.6 points from 45.8 in December, well above market expectations and its strongest reading since mid-2021, while the gauge of current conditions, although still deeply negative, improved to minus 72.7 from minus 81. The improvement was driven primarily by export-oriented industries, with particularly strong gains in mechanical engineering, steel and metals, chemicals, pharmaceuticals and the automotive sector, reflecting better than expected industrial production and orders at the end of 2025, optimism linked to the EU Mercosur trade agreement and confidence in Germany’s planned increase in public spending on defence and infrastructure. Sentiment also strengthened across the wider euro area, where the ZEW Economic Sentiment Index increased to 40.80 points in January from 33.70 points in December 2025, marking its highest level since mid 2024, even as warnings persist that structural weaknesses and escalating trade tensions, including the risk of retaliatory measures following US President Donald Trump’s threat to impose additional tariffs on German and European goods, could still weigh on the sustainability of the recovery.

We expect German economic sentiment to remain resilient in the near term, supported by robust export performance, industrial momentum, and planned public investment, though ongoing US-EU trade tensions and structural constraints could temper growth.