Back

Insights

EU Economy: Weekly Commentary – December 9, 2025

European Market Review

Adrian Van Den Bok and David Pintado

CEO

European Market Review

European bond yields rose. German 30-year yields hit 2011 highs. French bonds were weakest. EU stocks mostly rose. Euro +0.40%. Brent +2.47% amid Fed and geopolitical concerns.

Last week, European bond yields rose broadly as the ongoing sell-off pushed German 30-year yields to their highest level since 2011. French government bonds emerged as the weakest Eurozone credit, offering higher yields than both Italian and Greek debt, with France–Italy spreads reaching record levels—10-year bonds +3.9 bps and 30-year bonds +4.4 bps. Stock markets rose across the EU, with the exception of France, where the market declined 0.10%. The euro appreciated 0.40% against the US dollar. Brent crude advanced 2.47%, supported by expectations of an impending Federal Reserve rate cut, which would bolster economic growth and energy demand, alongside geopolitical tensions that could constrain supplies from Russia and Venezuela. Limited progress in Ukraine negotiations, potential tightening of restrictions on Russian crude, and the risk of US military intervention in Venezuela heightened supply concerns, partially offset by stable OPEC+ production, resulting in overall bullish momentum in the oil market.

Week: 1 – 5 December | |||||

Stock Market | Last | % CHG | Currency | Last | % CHG |

Euro Stoxx | 5723.93 | 0.98 | EUR/USD | 1.1645 | 0.40 |

Stoxx Europe 600 | 578.77 | 0.41 | Commodities | Last ($) | % CHG |

France | 8114.74 | -0.10 | Brent | 63.86 | 2.47 |

Germany | 24028.14 | 0.80 | Bond Market - 10 Years | Last | BP |

Italy | 43432.77 | 0.17 | Germany | 2.802% | 10.93 |

Portugal | 8198.25 | 1.08 | France | 3.533% | 11.75 |

Spain | 16688.50 | 1.94 | Italy | 3.494% | 8.66 |

Belgium | 5029.74 | -0.14 | Spain | 3.258% | 8.94 |

Europe View Synopsis

Eurozone inflation rose slightly in November, led by services, while Q3’25 GDP grew 0.3% QoQ, supported by domestic demand. External headwinds and structural challenges constrain short-term growth.

In November 2025, Eurozone inflation edged up, with headline inflation rising from 2.1% to 2.2% and core inflation stable at 2.4%, driven by services and a smaller negative energy contribution. Food inflation remained at 2.3%, while services inflation, the largest core component, increased to 3.5%, highlighting persistent domestic price pressures. Firms, particularly in services, expect further price rises, complicating the ECB’s path toward the 2% target, and a near-term rate cut is unlikely. Eurozone GDP grew 0.3% QoQ and 1.4% YoY in Q3 2025, supported by domestic demand, with household consumption up 0.2% QoQ, government spending 0.7% QoQ, and investment 0.9% QoQ. Imports rose 1.3% QoQ, outpacing exports, reflecting external headwinds and structural issues in major economies. Employment increased 0.2% QoQ and 0.6% YoY, while productivity remained stable. Private sector growth was driven by services (PMI 53.6), offsetting a manufacturing contraction (PMI 49.6). Overall, Eurozone activity is supported by domestic demand and services resilience, but external constraints limit near-term improvement.

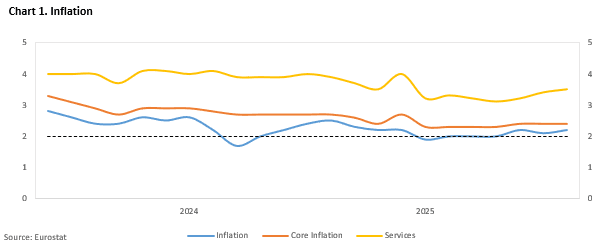

Inflation

Eurozone inflation ticked up in November, driven by services and less negative energy prices, keeping inflation near 2% and reinforcing expectations that the ECB will hold rates steady.

Eurozone inflation edged higher in November, reinforcing expectations that the European Central Bank will maintain its current policy stance at the December meeting and continue emphasising caution in its communication. Headline inflation increased modestly from 2.1% to 2.2%, while core inflation remained stable at 2.4%, underscoring a combination of disinflationary forces—such as easing wage growth, lower import prices, and still-weak economic momentum—offset by persistent inflationary pressures, most notably in services. The rise in headline inflation was largely due to a less negative energy contribution, while food inflation held steady at 2.3% and services inflation, the largest component of the core basket, moved up from 3.4% to 3.5%, highlighting the stickiness of domestic price pressures. Survey data indicate that firms, particularly in the services sector, continue to expect faster price increases ahead despite the soft macro backdrop, a dynamic that complicates the ECB’s path toward sustainably achieving its 2% target. With inflation still fluctuating within 0.2 percentage points of the target, market pricing remains aligned with the view that policy rates will stay on hold, and today’s figures offer little justification for repricing. By component, services show the strongest annual rate at 3.5%, up from 3.4% in October, followed by food, alcohol and tobacco at 2.5%, non-energy industrial goods at 0.6%, and energy at –0.5% compared with –0.9% in October, indicating that although broad disinflation has advanced considerably, the final stretch toward price stability is likely to remain uneven and gradual.

We expect inflation to dip below target in the coming months; however, persistent medium-term price pressures should prevent the ECB from adopting a more dovish stance, making a rate cut at the next meeting unlikely.

GDP

Eurozone GDP grew 0.3% QoQ and 1.4% YoY in Q3 2025, driven by domestic demand. Exports lagged imports, while employment and productivity remained stable.

Eurozone GDP expanded by 0.3% QoQ in the third quarter of 2025, strengthening from 0.1% QoQ in the previous quarter, while YoY growth reached 1.4%, slightly below the earlier 1.6% YoY, yet still reflecting resilient underlying momentum. The growth composition remained broadly balanced, with household consumption rising 0.2% QoQ, government expenditure increasing 0.7% QoQ, and gross fixed capital formation advancing 0.9% QoQ, marking a clear rebound after the Q2 contraction and supported by a modest additional contribution from inventories. However, the external sector continued to weigh on activity: imports rose 1.3% QoQ, outpacing the 0.7% QoQ increase in exports, highlighting persistent weakness in external demand and ongoing adjustments in global trade dynamics that pressure the region’s net trade balance. Labour market conditions remained consistent with moderate economic expansion, with employment growing 0.2% QoQ and 0.6% YoY, alongside a 0.4% QoQ increase in hours worked, indicating stable productivity and reaffirming labour market resilience. Overall, the data depict an economy supported by domestic demand—particularly investment and public expenditure—yet constrained by external headwinds, with the outlook increasingly reliant on the durability of the investment recovery and a gradual normalisation of global trade conditions.

We don’t expect significant improvement in the short term due to persistent external headwinds and structural problems in the main economies of the Eurozone.

Business Activity

Eurozone private sector expanded in November 2025, driven by robust services growth, while manufacturing contracted; new business and employment increased, supported by broad-based activity across key member states.

The Eurozone’s private sector continued to strengthen in November 2025, with the Composite PMI rising for a sixth consecutive month to 52.8 (October: 52.5), its highest level in two and a half years, driven primarily by services where the Services PMI Business Activity Index reached a 30-month high of 53.6 (October: 53.0). New business increased at the fastest pace since mid-2023, matching October’s peak, and employment rose almost entirely within the services sector, although overall job creation slowed to a marginal rate. By contrast, manufacturing conditions softened, with the manufacturing PMI falling to 49.6, signalling a modest contraction amid declining new orders, slower output growth to a nine-month low, reduced inventories, lower employment, and renewed supply-chain delays. Overall, new business rose for a fourth consecutive month, though export demand remained slightly negative, while backlogs fell—more sharply in manufacturing—and cost pressures accelerated to an eight-month high due to rising input prices across both sectors. Despite these cost pressures, output charge inflation eased to a six-month low.

Growth was broadly distributed across member states according to the composite PMI, with Ireland leading at 55.8 (a 42-month high), followed by Spain at 55.1 (a 2-month low), Italy at 53.8 (a 31-month high), Germany at 52.4 (flash: 52.1; a 2-month low), and France at 50.4 (flash: 49.9; a 15-month high), reflecting a broad-based expansion across the Eurozone.

The outlook is supported by a geographically broad recovery, the continued resilience of the services sector, and solid momentum in several key economies. Positive drivers include Germany’s fiscal stimulus and Spain’s sustained growth, although political uncertainty in France and the slower transmission of Italy’s Next Generation EU funds may temper the pace of further improvement.

We expect continued weakness in the manufacturing sector, with no short-term catalysts to support a recovery in activity, while robust services growth is likely to offset manufacturing softness.