Back

Insights

US Economy: Weekly Commentary – January 19, 2026

US Market Review

Adrian Van Den Bok and David Pintado

CEO

US Market Review

Bond yields rose across the curve, led by the long end. Equity markets closed mixed, with small caps outperforming. The dollar strengthened, oil remained supported by geopolitical risk, and gold and Bitcoin advanced.

Bond yields rose over the week, with increases observed across the entire yield curve, particularly at the long end. The 10-year U.S. Treasury yield reached its highest level since early September. At the same time, the spread between corporate bonds and U.S. Treasuries narrowed to its lowest level since 2007, indicating that investors are demanding minimal additional compensation to hold corporate debt over government securities. The spread has fallen below 0.9%, down from more than 2% in late 2022.

U.S. equity markets finished the week mixed. Micro-cap and small-cap stocks gained 2.97% and 2.10%, respectively, significantly outperforming large-cap stocks, which declined 0.38%. The “Magnificent 7” fell 2.21%. Sector performance was uneven, with real estate leading gains of more than 4%, while financials and communication services declined by 2.30%.

In currency markets, the U.S. dollar strengthened by 0.33% against the euro. WTI crude oil rose 0.88%, supported by ongoing tensions related to Iran. Although concerns over an immediate U.S. response to recent violent protests have eased, geopolitical risks remain elevated as the United States increases its military presence in the Middle East, maintaining a risk premium in oil prices. Gold advanced 1.83% over the week, while Bitcoin gained 5.60%.

Week: 12 – 16 January | |||||

Stock Market | Last | % CHG | Commodities | Last | % CHG |

S&P 500 | 6940.01 | -0.38 | WTI | 59.30 | 0.88 |

Nasdaq 100 | 25529.26 | -0.92 | Gold | 4601.10 | 1.83 |

Russell 2000 | 2677.74 | 2.04 | Currency | Last | % CHG |

Bonds | Last | BP | USD/EUR | 0.8622 | 0.33 |

US - 10 Years | 4.227% | 4.50 | Cryptocurrency | Last | % CHG |

US - 2 Years | 3.592% | 5.10 | Bitcoin | 95039.30 | 5.60 |

US Market Views Synopsis

U.S. inflation eased in December, with core CPI at 2.6% YoY. Retail sales rose 0.6% MoM in November, and industrial production grew 0.4% MoM, showing resilient economic activity.

In December 2025, U.S. inflation moderated, with headline CPI rising 2.7% YoY and core CPI, excluding food and energy, at 2.6% YoY, its lowest since March 2021, reflecting broadly subdued price pressures. Shelter costs eased, with rent inflation at 2.9% YoY and overall shelter at 3.2% YoY, while goods prices remained largely flat, services inflation slowed to 3.0% YoY, and energy costs increased modestly. These trends suggest the Federal Reserve has room for at least two rate cuts in 2026, with a potential third if labour market conditions soften. U.S. retail sales rose 0.6% MoM in November, led by fashion, nonstore, and health and beauty gains, while autos and building materials lagged, highlighting resilient consumer spending supported by holiday shopping and larger tax refunds. Industrial production grew 0.4% MoM in December, with manufacturing and utilities strengthening and capacity utilization rising to 76.3% MoM, indicating continued economic resilience supporting growth into early 2026.

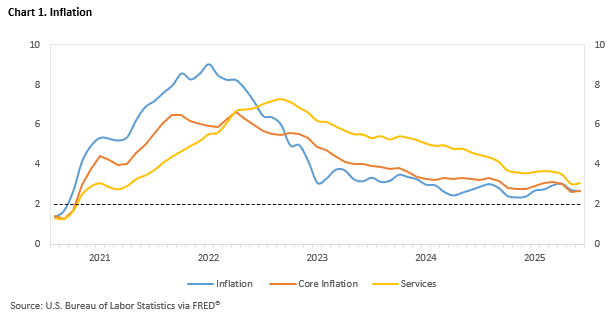

Inflation

December US inflation eased. Headline CPI was 2.7% and core 2.6% YoY. Moderating shelter, contained goods, and services suggest the Fed has room for at least two rate cuts this year.

December’s US inflation data reinforce a sustained disinflationary trend, supporting the case for further monetary easing and positioning the Federal Reserve for at least two rate cuts this year. Headline CPI rose 2.7% YoY, while core CPI—excluding food and energy—held at 2.6% YoY, its lowest level since March 2021, reflecting broadly subdued price pressures. Goods prices remained largely flat, highlighting minimal tariff pass-through, while services inflation moderated to 3.0% YoY. Energy costs increased 2.3% YoY, providing a modest upward contribution to headline inflation, while shelter continued to ease, with rent inflation at 2.9% YoY and overall shelter at 3.2% YoY, down from November. Although isolated pockets of volatility persist—most notably in recreation services driven by record admission costs—these appear idiosyncratic. Overall, the data indicate that inflation is trending lower, underpinned by moderating shelter costs, contained goods prices, and cooling wage pressures, allowing policymakers to remain on hold in the near term while leaving the balance of risks skewed toward at least two rate cuts later in the year, with a potential third if labour market conditions soften further, supporting continued economic expansion without reigniting inflationary pressures.

We expect inflation to remain on a gradual downward trajectory throughout 2026. Moderating shelter costs contained goods prices, and easing services inflation support the view that the Fed has scope for at least two further rate cuts this year.

Retail Sales

U.S. retail sales rose 0.6% in November 2025, led by fashion, nonstore, and health/beauty gains, while autos and building materials lagged, highlighting resilient holiday consumer spending despite economic uncertainty.

U.S. retail sales surged 0.6% in November 2025, surpassing expectations of a 0.4% gain and marking a 3.3% increase year-over-year, highlighting the economy’s resilience heading into the holiday season. Nonstore retail led the charge with a 7.2% YoY jump, while clothing and health/personal care also posted strong gains of 7.5% and 6.7% respectively. Fashion retail, in particular, accelerated sharply with a 7.4% YoY increase in November, driven by early Christmas shopping and Black Friday promotions, well above overall retail growth. Auto dealers bucked the trend, declining 1.1% YoY, and building materials lagged, reflecting uneven demand across sectors. Despite low consumer confidence and lingering labour market concerns, households continued spending, bolstered by strength in specialty retailers, dining, and online channels. Core retail sales, stripping out volatile components, rose a solid 0.4%, confirming steady underlying consumer demand. The strong holiday-season spending suggests Americans are prioritizing discretionary purchases even as essentials become more expensive, and momentum is expected to continue into early 2026, supported by larger-than-usual tax refunds and lower payroll withholding, giving households extra cash to spend or pay down debt. Overall, the data underscore that consumer spending—particularly in fashion—remains a central pillar of U.S. economic growth, helping offset pressures from tariffs, inflation, and policy uncertainty.

We expect U.S. retail sales to remain resilient in 2026, supported by strong consumer spending and tax refunds, while inflation, tariffs, and slower wage growth may weigh on lower-income households.

Industrial Production

U.S. industrial production rose 0.4% MoM in December. Manufacturing and utilities strengthened, capacity utilization improved. Resilient hard data tempered expectations for near-term interest-rate cuts among investors.

U.S. industrial production delivered a clear upside surprise in December, rising 0.4% MoM against a 0.1% consensus forecast and matching an upwardly revised increase in November, lifting output growth to 2.0% YoY and underscoring the continued resilience of hard economic data. Manufacturing output rose 0.2% MoM, confounding expectations for a contraction, with nondurable goods production up 0.3% MoM, led by petroleum, while durable goods output edged 0.1% higher as strength in primary metals, electrical equipment and aerospace more than offset a 1.1% MoM decline in motor vehicles. Excluding autos and parts, manufacturing production advanced a solid 0.5% MoM for a second straight month, even as vehicle assembly rates slipped. Utilities output surged 2.6% MoM amid colder weather and stronger natural gas production, offsetting a 0.7% MoM pullback in mining following November’s jump. Capacity utilization increased to 76.3%, above market expectations, with manufacturing utilization steady at 75.6%, reinforcing a macro backdrop that contrasts with weaker survey data and continues to curb expectations for imminent interest-rate cuts.

We expect industrial momentum to support economic growth early in 2026. Strong manufacturing and utilities suggest resilience, likely keeping the Federal Reserve cautious on near-term rate cuts.