Back

Insights

US Economy: Weekly Commentary – January 26, 2026

US Market Review

Adrian Van Den Bok and David Pintado

CEO

US Market Review

Treasury bonds had mixed results, with foreign holdings hitting $9.4T. U.S. stocks mostly fell, while the dollar weakened. Oil and gold surged. Bitcoin dropped amid geopolitical and supply concerns.

Treasury bonds had a mixed week, with long-term issues outperforming short-term ones amid a broader decline in the fixed-income market. The $25 billion Danish public pension fund Akademiker Pension plans to exit U.S. Treasury holdings by month-end, citing concerns over credit risks tied to President Trump’s policies. Foreign holdings of U.S. Treasuries rose $112.8 billion in November, reaching a record $9.4 trillion. Japan added $2.6 billion to $1.2 trillion, the UK increased by $10.6 billion to $888.5 billion, and Canada’s holdings jumped $53.1 billion to $472.2 billion. In contrast, China reduced its holdings by $6.1 billion to $682.6 billion, the lowest since 2008, while Belgium, which includes Chinese custodial accounts, rose $12.6 billion to a record $481.0 billion.

U.S. stock markets closed the week lower, with micro-cap stocks up 0.72%, while small-, mid-, and large-cap indexes fell 0.35%, 0.60%, and 0.35%, respectively. The “Magnificent 7” gained 1.11%, though Apple extended its losing streak to eight consecutive weeks, the longest since May 2022. By sector, real estate and financials led the declines at 2.30% and 2.50%, while energy and materials rose 3.15% and 2.65%.

In currency and commodity markets, the U.S. dollar fell 2.00% against the euro, marking its worst week since July. WTI crude gained 3.37% as tensions with Iran escalated, with sanctions on oil shipments and a U.S. naval presence raising supply concerns. Kazakhstan’s Tengiz oilfield remains shut after a fire, further tightening supply. Gold surged 8.30% during the week, approaching $5,000 after three consecutive weekly gains, while Bitcoin fell 6.26%.

Week: 19 - 23 January | |||||

Stock Market | Last | % CHG | Commodities | Last | % CHG |

S&P 500 | 6915.61 | -0.35 | WTI | 61.30 | 3.37 |

Nasdaq 100 | 23501.24 | -0.06 | Gold | 4983.10 | 8.30 |

Russell 2000 | 2669.16 | -0.32 | Currency | Last | % CHG |

Bonds | Last | BP | USD/EUR | 0.8453 | -2.00 |

US - 10 Years | 4.233% | 0.60 | Cryptocurrency | Last | % CHG |

US - 2 Years | 3.607% | 1.50 | Bitcoin | 89086.20 | -6.26 |

US Market Views Synopsis

U.S. GDP growth accelerated strongly. Consumption and investment drove momentum. Inflation stayed stable. Consumer sentiment improved slightly but remained weak amid price pressures and labour uncertainty.

U.S. economic momentum strengthened significantly, with third-quarter GDP revised up to a 4.4% annualized rate, the fastest in two years, and fourth-quarter growth tracking near 5.4%, pointing to broad-based expansion driven by resilient consumer spending, stronger exports, rising business and private investment, and higher government spending, while inventories weighed less on growth. Consumer spending remained the dominant contributor, net exports added meaningfully, and income-side measures also showed solid gains, reinforcing the picture of growth well above trend. Inflation pressures remained stable, with headline and core PCE holding around 2.8 to 2.9%, giving the Federal Reserve little urgency to cut rates at its January 2026 meeting. Meanwhile, consumer sentiment improved modestly but remains more than 20% below last year’s level, reflecting continued pressure from elevated prices, labour market uncertainty, and persistently high inflation expectations, despite some easing in short-term outlooks.

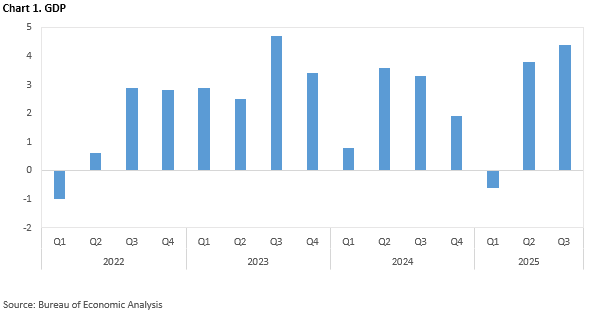

GDP

US GDP growth accelerated, with Q3 revised to 4.4% and Q4 tracking near 5.4%, driven by resilient consumption, exports, and investment. Inflation remained stable and private investment strengthened.

U.S. economic momentum continued to strengthen as third-quarter GDP was revised up to a 4.4% annualized rate, the fastest pace in two years, while fourth-quarter growth is tracking an even stronger 5.4% according to the Atlanta Fed’s GDPNow model, pointing to a broad-based acceleration across the economy. The upward revision to Q3 reflected firmer exports and business investment, partly offset by a modest downward revision to consumer spending, with real GDP revised higher by 0.1 percentage point from the initial estimate. Relative to the second quarter, growth accelerated as investment, exports, government spending, and household consumption all improved, while net trade contributed more positively and inventories were a smaller drag on activity. Consumer spending remained the dominant driver of growth, contributing 2.34 percentage points, while net exports added 1.62 points, government spending contributed 0.38 points, and fixed investment added 0.15 points. From an income and production perspective, real gross output rose 3.2%, driven by strong gains in private services and goods-producing industries, while real gross domestic income increased 2.4%, leaving the average of GDP and GDI at a solid 3.4%. Inflation pressures remained stable, with the PCE price index rising 2.8% and core PCE increasing 2.9%, unchanged from prior estimates. Looking ahead, fourth-quarter momentum appears even stronger, with private domestic investment tracking a robust 6.4% increase, reinforcing the picture of an economy expanding well above trend with exceptionally strong underlying growth dynamics.

We expect no rate cuts at the January 28, 2026 FOMC meeting, as robust growth, firm demand, and stable inflation give the Fed little urgency to ease policy so early in the year.

Consumer Sentiment

Consumer sentiment rose modestly but remains below last year amid prices and labour market worries. Inflation expectations eased in the short term, while long-term uncertainty stayed elevated.

Consumer sentiment rose by roughly 3.5 index points this month, reflecting modest but broad-based improvements across all major components of the index and spanning income levels, educational attainment, age groups, and political affiliations. Even so, overall sentiment remains more than 20% below its level a year ago, underscoring persistent pressure on household purchasing power from elevated prices and growing concerns about a potential softening in labour market conditions. Beyond tariff policy, consumers appear largely unconcerned with foreign developments when forming their economic views; it is also worth noting that survey interviews concluded on January 19, shortly after President Trump announced additional tariffs on eight European countries. On inflation, year-ahead expectations declined to 4.0%, the lowest reading since January 2025, though still above the 3.3% level recorded at that time, while long-run inflation expectations edged up from 3.2% to 3.3%, exceeding the ranges observed in 2024 and remaining well above pre-pandemic norms. Although uncertainty surrounding short-term inflation expectations has eased since mid-2025, it remains elevated and comparable to levels last seen in 2022.

We expect consumer sentiment to remain fragile despite recent gains, as elevated prices, labour market uncertainty, and persistent inflation expectations continue to weigh on household confidence in the near term.